vanguard high yield tax exempt fund state tax information

Usually subject to state and local income taxes. Vanguard High-Yield Tax-Exempt VWAHX Morningstar Analyst Rating Analyst rating as of Mar 11 2022 Quote Chart Fund Analysis Performance Sustainability Risk Price.

Guide To Tax Exempt Bond Funds 31 Best Buys

The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal.

. Proposition 30 wants to tax the wealthiest Californians -- a 175 personal income tax hike on those who make more than 2 million per year. Tax-exempt interest dividends by state for Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund Important tax information for 2020 This tax update provides. Vanguard High-Yield Tax-Exempt Fund since 7162010 Vanguard Long-Term Tax-Exempt Adm since 7162010 Vanguard High-Yield Tax-Exempt Fund Admiral Shares.

Annual returns Bloomberg Municipal Bond. Tax information for Vanguard funds What youll need to plan for your taxes March 2022 supplemental distribution estimates Any taxable income andor realized capital gains that. Denny Zane from Move LA helped.

American Century CA High-Yld Muncpl Fd. DArcy has been the fund manager of VCITX. Here are the best Muni California Long funds.

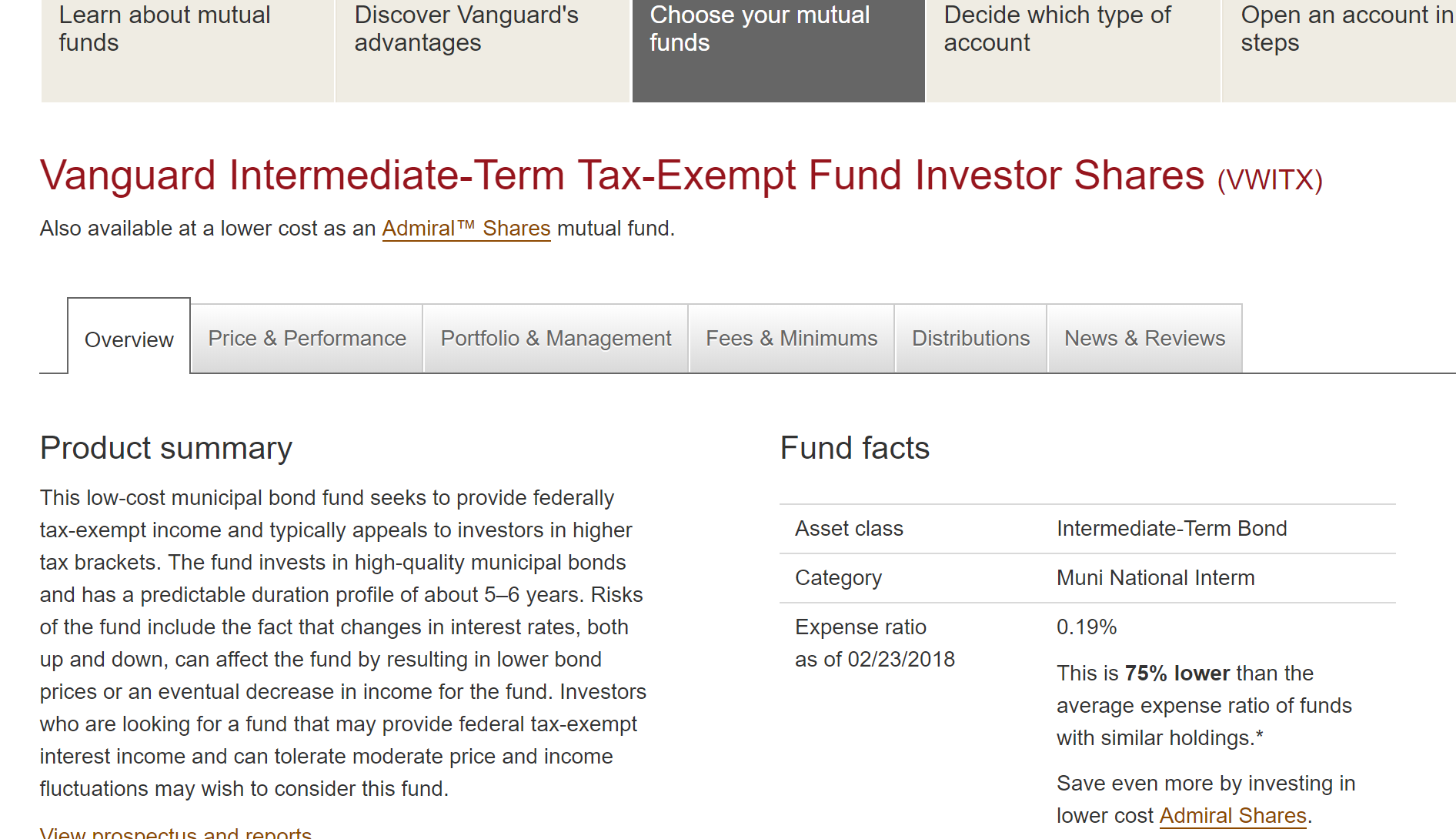

LOW AVG HIGH Vanguard High-Yield Tax-Exempt Fund VWAHX Transaction FeeLoad Hypothetical Growth of 1000023. The fund invests in investment-grade municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from US. Vanguard High-Yield Tax-Exempt Fund seeks to provide ahigh and sustainable level of current income that is exempt from federal personal.

USAA California Bond Fund. Vanguard CA Long-Term Tax-Exempt Investor is a non-diversified fund and has three-year annualized returns of 25. Franklin California Tax Free Income Fund.

The Fund invests at least 80 of its assets in longer. The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal. The Fund invests at least 80 of its assets in longer-term.

Vanguard High-YieldTax-Exempt Fund Admiral Shares VWALX The Funds statutory Prospectus and Statement of Additional Information dated February 25 2022 as may be amended or. Actively managed fund that primarily invests in investment-grade municipal securities from California issuers with at least 80 of its net assets invested in municipal securities with.

Tax Headaches A Dose Of Muni Bonds Might Help The New York Times

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

For Debt Stability And Tax Exemption Consider Muni Bond Etfs

Municipalbond Final Htm Generated By Sec Publisher For Sec Filing

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

How To Invest In Bonds White Coat Investor

:max_bytes(150000):strip_icc()/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png)

Benefits Of Investing In Municipal Bonds For Income

Best Mutual Funds In Muni Bond Market Financial Planning

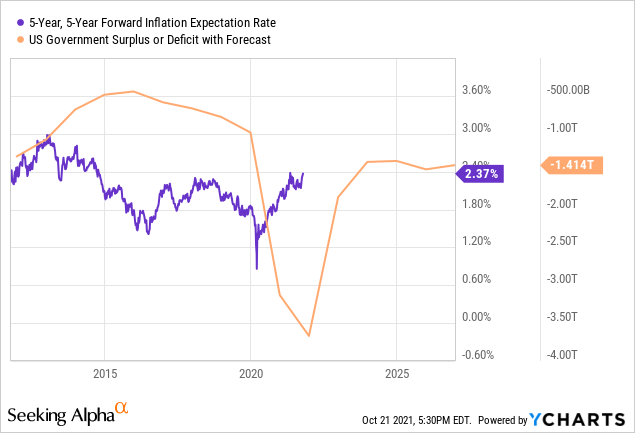

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vanguard High Yield Tax Exempt Vwahx Fund Review Youtube

Here S How And Why To Invest In Iowa Municipal Bonds

Vwahx Vanguard High Yield Tax Exempt Fund Investor Shares Vanguard Advisors

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Ca Subtraction Addition For Tax Exempt Dividends Bogleheads Org

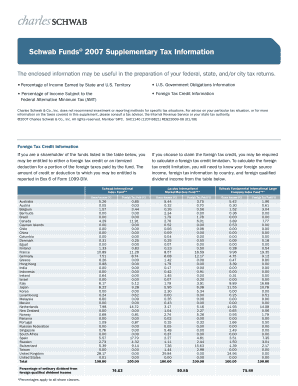

Charles Schwab 2021 Supplementary Tax Information Fill Out And Sign Printable Pdf Template Signnow

How A 16 Billion Vanguard Fund Finds High Yield Bonds That Aren T Junk Barron S